Why This Analyst Thinks MicroStrategy Stock Can Soar to a New Street-High Target of $680

Digital currency holding company MicroStrategy, now rebranded as Strategy (MSTR), recently received a stock price upgrade from TD Cowen. Analysts at the investment firm raised the price target from $590 to a Street high of $680 because of surrounding optimism regarding the company’s Bitcoin (BTCUSD) operations.

The company has been acquiring Bitcoin at a steady pace. In fact, Strategy recently purchased 4,225 more BTC for $472.5 million. This announcement also came at a time when Bitcoin reached a new all-time high, climbing above the $123,000 mark.

TD Cowen highlighted that the company stands out as the largest corporate holder of Bitcoin, and while competitors might try to emulate Strategy, the company has a significant cost of capital advantage.

About Strategy Stock

Incorporated in 1989 and headquartered in Tysons Corner, Virginia, Strategy is an enterprise analytics and business intelligence company. Originally known for its software solutions that enabled organizations to analyze vast datasets, the company has transformed into the largest corporate holder of Bitcoin under the watchful eye of Executive Chairman Michael Saylor.

In 2020, the company shifted its focus from analytics to become a significant holder of cryptocurrency, aggressively buying Bitcoin as a treasury reserve asset, thereby positioning itself at the forefront of corporate crypto adoption. Now, the company can almost act as a proxy for holding crypto. The firm currently has a market capitalization of $115 billion.

This year, given the conducive environment that has emerged in the cryptocurrency market, Strategy has been increasing its Bitcoin holdings, which has given a boost to its stock. Over the past 52 weeks, MSTR stock has gained a massive 172%. The stock is also up 46% year-to-date (YTD). While MSTR is about 28% lower than its 52-week high of $543, the stock reached a YTD high of $457.22 on July 16.

However, Strategy stock is currently trading at an eye-watering valuation. Its price sits at 266 times sales. Needless to say, this valuation is highly stretched compared to the industry average.

Bitcoin Acquisition and Financials

Strategy is raising capital to acquire more Bitcoin. Prior to the recent buying, the company purchased 4,020 BTC in May. Strategy is actively financing its Bitcoin acquisitions through at-the-market (ATM) offerings. Strategy last declared an ATM program pursuant to which the company may issue and sell shares of its 10.00% Series A Perpetual Stride Preferred Stock. The offering is worth a total of $4.2 billion.

For the first quarter of 2025, Strategy’s revenues declined 3.6% year-over-year (YOY) to $111.1 million. However, the company’s subscription services revenues grew by 61.6% annually to $37.1 million.

Strategy reported a 13.7% BTC Yield as of the end of Q1. This is a key performance indicator that indicates the percentage change of the ratio between the company’s BTC holdings and its assumed diluted shares outstanding. At the end of Q1, Strategy reported $5.8 billion in "BTC $ Gain.” For the full year of 2025, the company raised its BTC Yield target from 15% to 25% and increased the BTC $ Gain target from $10 billion to $15 billion.

For Q2, Wall Street analysts expect Strategy’s loss per share to narrow by 84% annually. This year, the company is expected to turn a profit of $7.30 per share, which indicates a 209% YOY increase.

What Do Analysts Think About Strategy Stock?

Analysts have become exceptionally bullish on Strategy stock amid its massive cryptocurrency bet. In addition to the price upgrade from TD Cowen, the company’s stock has received several more upgrades.

Barclays analyst Ramsey El-Assal raised the price target on MSTR stock from $421 to $475 while maintaining an "Overweight" rating. This upgrade reflects confidence in the strategic direction that the company has taken and its performance forecasts.

Meanwhile, Cantor Fitzgerald analyst Brett Knoblauch cut his price target by a small amount from $619 to $614. However, the analyst maintained the overall rating on the stock at “Overweight.” Knoblauch also believes that Strategy will be able to maintain its premium NAV and continue purchasing BTC in the near future.

Finally, analysts at H.C. Wainwright raised their price target from $480 to $521 while keeping a “Buy” rating. This raise was predicated upon Strategy raising its 2025 guidance and doubling its capital raising plan. H.C. Wainwright also mentioned the upside exposure the company is gaining from its Bitcoin holdings.

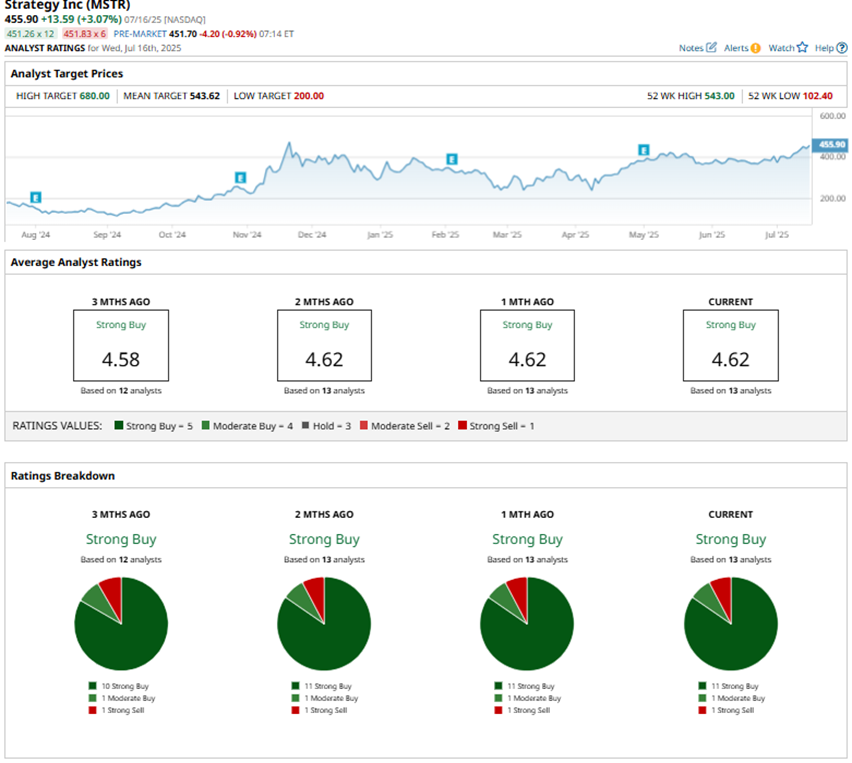

Strategy has become a popular name on Wall Street, with analysts giving it a consensus “Strong Buy” rating overall. Of the 13 analysts rating the stock, a majority of 11 analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and one analyst gives it a “Strong Sell” rating. The consensus price target of $543.62 represents about 28% upside from current levels, while TD Cowen's Street-high price target of $680 indicates 61% potential upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.